Description

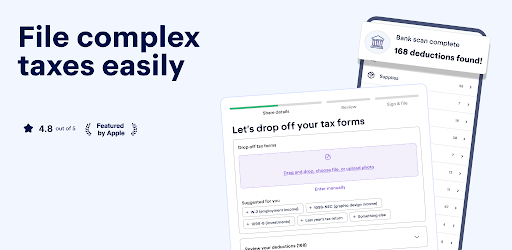

- Connect your bank for instant personalization

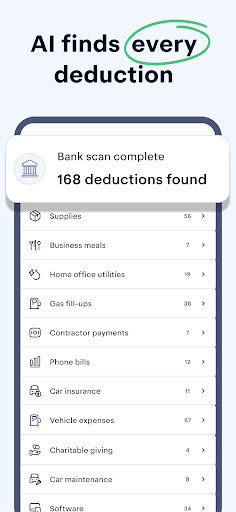

- Automatically uncover tax breaks

- File with IRS & all 50 states

- Supports W-2, 1099, investments, and more

- 300+ types of credits and deductions

- Smart audit protection included

- An assigned tax assistant answers questions

Keeper is especially valuable for small business owner, self-employed digital freelancers, and 1099 independent contractors because it automatically uncovers tax deductible business expenses among past transactions.

Keeper is secured using SSL 256-bit encryption— the same security protocol banks use — to ensure that your sensitive personal information is fully protected and securely stored. Keeper does not store your online banking credentials, or sell your information to anyone.

DISCLAIMER: Keeper does not represent a government entity. The websites for the IRS (https://www.irs.gov) as well as state and local tax authorities are the source of information for specific tax requirements.

TERMS OF USE: https://www.keepertax.com/terms

PRIVACY POLICY: https://www.keepertax.com/privacy

User Reviews for Keeper 1

-

for Keeper

Keeper is a game-changer for tax filing! AI guidance and expert preparers ensure seamless handling of complex taxes.